What is Impact

Investing?

At a Glance

From its origins in the 1960s, impact investing has continued to gain acceptance as a prudent investment discipline. Key characteristics include:

Definition. Impact investing is most often defined as the practice of investing into companies, organizations and funds with the intention to generate measurable social and environmental impact alongside a financial return.[1] Impact investing is part a of broader set of practices known as SRI–sustainable and responsible impact investing — and ESG — incorporating Environmental, Social and Governance factors into investment decision-making. Foundations often refer to these techniques as mission investing, and many investors who apply them in regions and neighborhoods refer to them as community or place-based investing. For grantmakers, impact investing can enhance results; it is not meant to substitute for still critically needed grant support.

Motivation. Impact investments enable philanthropic and other socially motivated investors to amplify the impact they can achieve through grants or other community-focused activities, while bringing their investment assets into alignment with mission and values.

Financial Return. Impact investments can be made across a range of risk-adjusted expected financial returns.

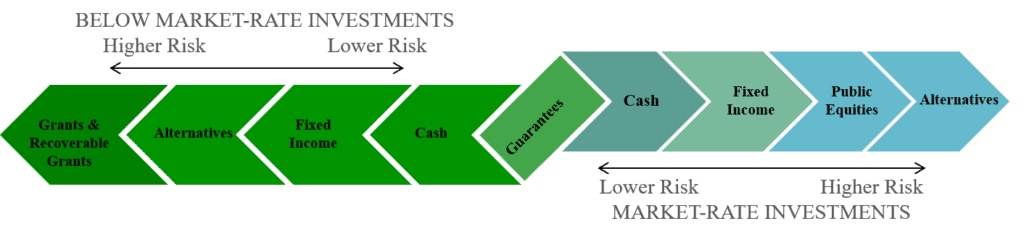

Structure. Impact Investments can be made in any asset class (investment structure) across the spectrum of risk including private equity, public equity, fixed income, loans, cash and guarantees (see Figure 1).

Figure 1: Continuum of Impact Investing Asset Classes

As distinct from ESG and SRI, impact investments are typically private market transactions such as loans or investments in community organizations, funds or projects. They may also support progress in a sector across a national or global footprint, such as quality, affordable healthcare or renewable energy.

Impact Investors. Impact investors include foundations, health systems, banks, pension funds, insurance companies, faith-based organizations, corporations, wealth managers, families, and individuals who seek measurable social and environmental benefits along with financial returns on investments. Government is a frequent partner through complementary grants, technical assistance programs, loan guarantees, insurance and/or tax incentives that reduce investment risk for the private sector.

Trends

Increasing Traction. As noted, impact investing has become a global practice that continues to grow rapidly and gain acceptance as a prudent investment discipline.

The Global Impact Investing Network (GIIN)’s 2018 annual survey found that 226 major fund managers, foundations, banks, pension funds, family offices and development finance institutions reported $228.1 billion in impact investments under management. They invested $35.5 billion in new impact investments in 2017 and planned to increase that amount 8% in the coming year.[2]

Financial and Social Performance Expectations. A vast majority of these investors reported that their impact investments met or exceeded their expectations for both impact (97%) and financial performance (91%). Two-thirds target risk-adjusted, market rates of return, while noting the important role played by more concessionary and flexible capital in the marketplace.

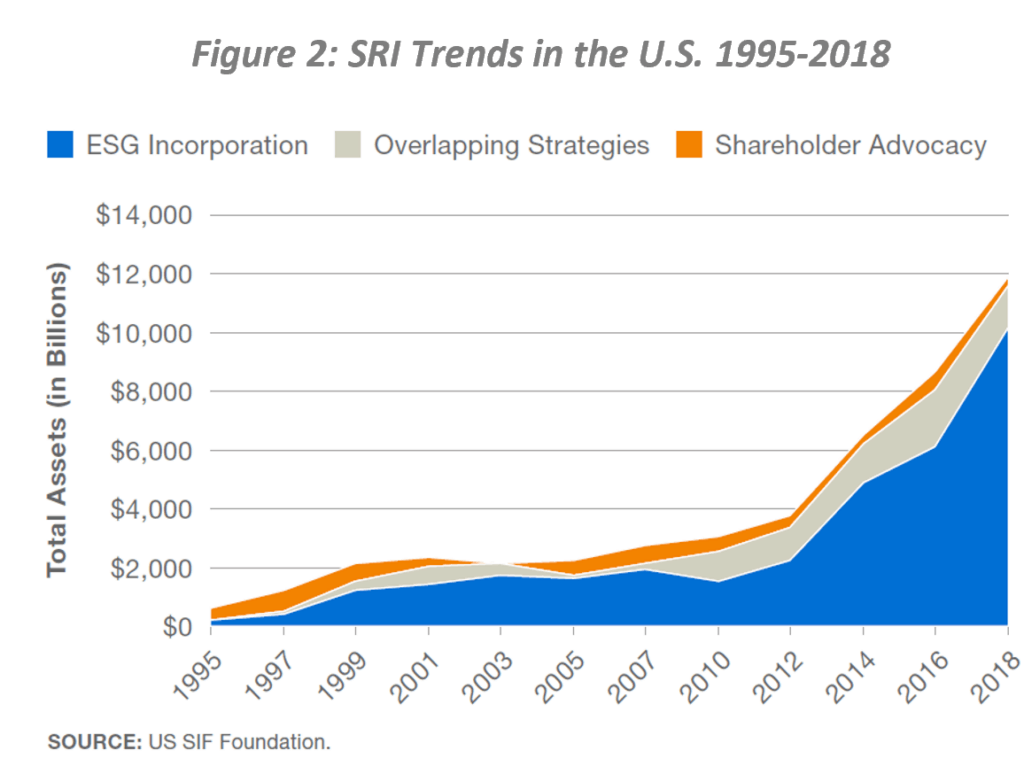

The broader practice of sustainable, responsible and impact investing has also continued to gain traction. SRI assets reached $12.0 trillion in the United States in 2018, up 38% from $8.7 trillion in 2016. Much of this growth is driven by asset managers, who now apply ESG criteria across $11.6 trillion in assets, up 44% from $8.1 trillion in 2016.[3]

Impact Investing in Wisconsin

Wisconsin foundations, faith-based investors and socially-motivated individuals have been among the nation’s leaders in impact investing.

[2] https://thegiin.org/research/publication/annualsurvey2018

[3] USSIF Foundation Report on US Sustainable, Responsible and Impact Investing Trends 2018. https://www.ussif.org/currentandpast